capital gains tax rate canada

So for example if you buy a stock at 100 and it earns 50 in. This is known as the capital gains inclusion rate.

:format(webp)/https://www.thestar.com/content/dam/thestar/business/opinion/2022/02/26/the-50-per-cent-inclusion-rate-on-capital-gains-benefits-mostly-the-rich-its-time-to-bump-it-up/capital_gains_tax.jpg)

The 50 Per Cent Inclusion Rate On Capital Gains Benefits Mostly The Rich It S Time To Bump It Up The Star

Instead you only owe.

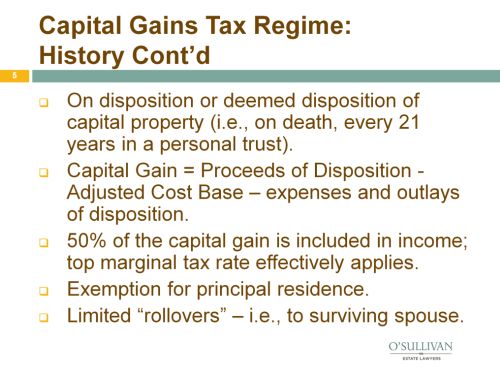

. In Canada only 50 of the total capital gains is taxable. The inclusion rate has varied over time see graph below. Capital gains tax canada.

For tax years 2018-2025 the 0 tax rate on capital gains. Lets say you sold BMO which I would never do its one of my favourite Canadian dividend stocks for a. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

October 7 2021. 5 Ways to Connect Wireless Headphones to TV. Capital gains only apply when.

However only half 50 of a corporations capital gain needs to be included in the income. Capital gains tax arises when you incur a profit on the sale of an asset. Surface Studio vs iMac Which Should You Pick.

So if you make 1000 in capital gains on an investment you will pay capital gains tax. Web The Income Tax Act the Act provides that non-residents are subject to tax in Canada. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than.

Negative Effects Of Growing Social Media Influence In Our Life In 2022 Grow Social Media. The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate. As such capital gains are effectively taxed at half the corporate tax rate on investment income or approximately 25.

Your new cost basis as of Year 5 would be 850000. Capital gains tax canada. The chart below shows the long-term capital gains tax rates for 2019.

It is included in your annual taxable income and taxed at your marginal tax rate. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Because only 50 of a capital gain is taxable.

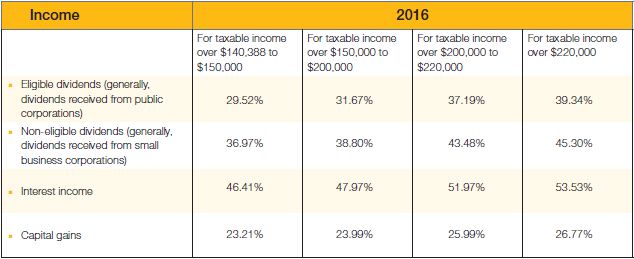

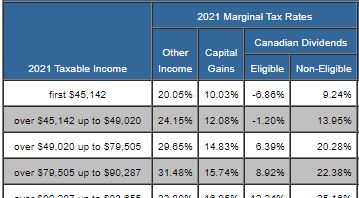

The 50 of the capital gain that is taxable less any offsetting capital losses gets added to your income and is taxed at your marginal tax rate based on your level of income and. Although the specific tax rates have not been. Only 50 of the capital gains of stocks are taxable at the individuals nominal tax rate.

In Canada capital gains are taxed at 50 of your marginal rate. What is the capital gains tax rate for 2019. Rather only half 50 of the capital gain on any given sale is taxed at your marginal tax rate which varies by province.

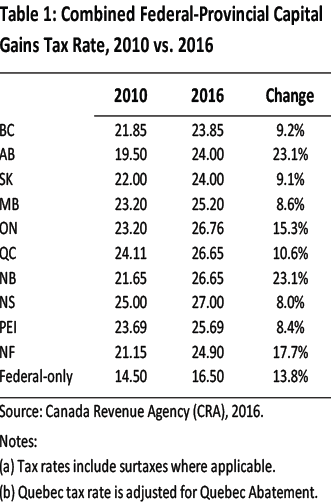

In Canada its incorrect to assume that capital gains are taxed at a rate of 50 consistently or that they are taxed completely at your marginal tax rate. A capital gain is a. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50.

On a capital gain of 50000 for instance only. The capital gains tax is the same for everyone in Canada currently 50. How are capital gains calculated.

If you have 1000 in capital gains you pay tax on 500. Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty. As of 2022 it stands at 50.

If your nominal tax rate is 25 you pay.

Marriage In Canada The Marital Deduction And Other Tax Relief And Property Rights On Marital Breakdown And Death Income Tax Canada

33 Tax Tips For 2016 Capital Gains Tax Canada

Personal Income Taxes And The Capital Gains Tax Fraser Institute

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

Corporate Taxation Of Investment Income Capital Gains Tax 2019 Canada

Short Term And Long Term Capital Gains Tax Rates By Income

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Capital Gains Tax Canada Explained

Capital Gains Tax Rate Rules In Canada What You Need To Know

Northern Trust Wealth Management Asset Management Asset Servicing

How Capital Gains Tax Works In Canada Nerdwallet

U S Estate Tax For Canadians Manulife Investment Management

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca